Ian Spence

Scagilize Network Partner (Trainer & Consultant), Advisor & SAFe Fellow

The independent thinker and SAFe Fellow has co-authored a number of popular books. For Scagilize, he regularly writes down his thoughts and insights all around the world of SAFe

Ian Spence on:

Part 2 – A Jargon-free Comparison of Traditional and Lean Portfolio Management Practices

Last month, we started our jargon free comparison of traditional and lean portfolio management practices and discussed why we should:

- Invest in people and products, not projects.

- Stop over preparing and trying to fix everything up front

- Let the results, not the plans, drive the work

This month, we will wrap up our jargon free comparison by looking at why you should:

- Stop being afraid of failure

- Use transparency to enable faster decision-making

- Let people focus and own their products

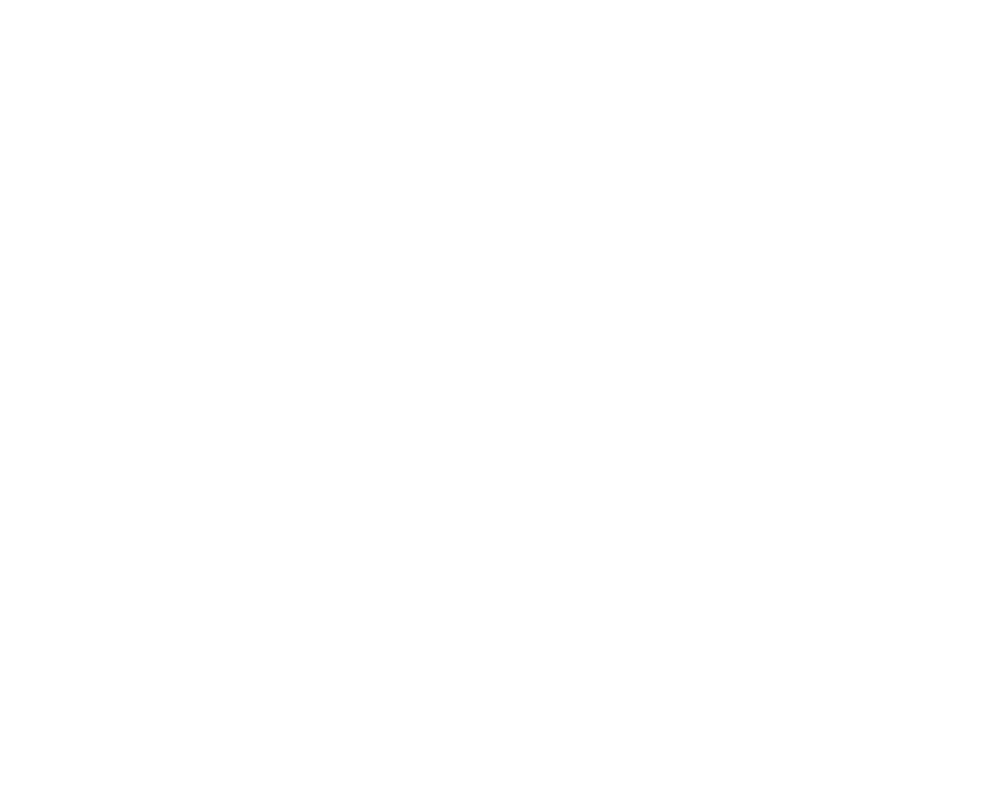

Don’t be afraid of failures.

Treating the portfolio as a vehicle for investment rather than the administration of projects requires a wholesale change in the way we think about risk and the way we think about failure.

Traditionally, we've been very risk averse with a focus on sure things and near-term investments. And once we start something we're going to finish, and we're going to make out that it's successful even if it isn't - because failure is not an option!

This is not an effective way to learn and incrementally deliver value. With Lean Portfolio Management, we will balance our investments across multiple investment horizons balancing our short, medium, and long-term investments to make sure we create a sustainable, profitable future for our business.

Risks will be taken as part of our approval process; we'll decide whether we wish to take risks or not. But where we do risky things and they're not working out; we will fail fast.

With agile product development to support our Lean Portfolio Management, we will take an experimental approach with a continuous learning culture. So, although agile is not a silver bullet - it does not guarantee that everything will be successful - the failures are much less expensive. We will fail within a few weeks or months on an agile initiative, rather than failing at the end of the time available, which is what's typical of waterfall. Treating the portfolio as a vehicle for investment rather than the administration of projects requires a wholesale change in the way we think about risk and the way we think about failure.

Traditionally, we've been very risk averse with a focus on sure things and near-term investments. And once we start something we're going to finish, and we're going to make out that it's successful even if it isn't - because failure is not an option!

This is not an effective way to learn and incrementally deliver value. With Lean Portfolio Management, we will balance our investments across multiple investment horizons balancing our short, medium, and long-term investments to make sure we create a sustainable, profitable future for our business.

Risks will be taken as part of our approval process; we'll decide whether we wish to take risks or not. But where we do risky things and they're not working out; we will fail fast.

With agile product development to support our Lean Portfolio Management, we will take an experimental approach with a continuous learning culture. So, although agile is not a silver bullet - it does not guarantee that everything will be successful - the failures are much less expensive. We will fail within a few weeks or months on an agile initiative, rather than failing at the end of the time available which is what's typical of waterfall.

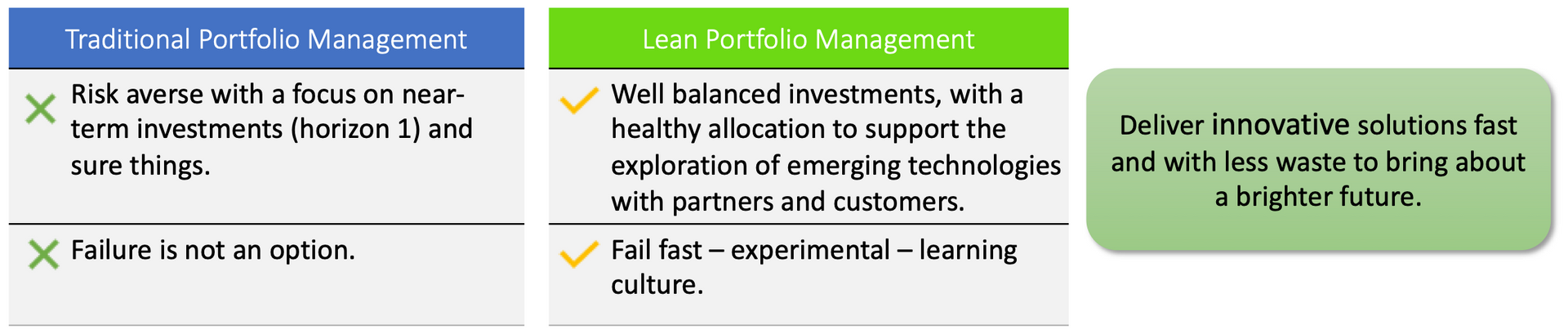

Use transparency to enable faster decision making.

Our desire for speed and an experimental approach requires us to think differently about the way we make decisions and report our progress.

Once we have decided to make an investment, we need to move away from traditional centralized decision-making with monthly reports based on document sign-offs and earned value.

This faster fact-based decision-making will lead to a shorter time to action, which will lead in turn to better outcomes across the whole of our portfolio.

We need to have more decentralized decision-making, the portfolio will set guardrails, letting the teams pull the work to make sure they deliver the most value. Our approach will be trust but verify rather than command and control.

In return, we need full transparency of everything that's going on within our portfolio, supported by real-time trends and customer feedback, to support the strategic and investment decision-making at the highest levels of our organization.

This faster fact-based decision-making will lead to a shorter time to action, which will lead in turn to better outcomes across the whole of our portfolio.

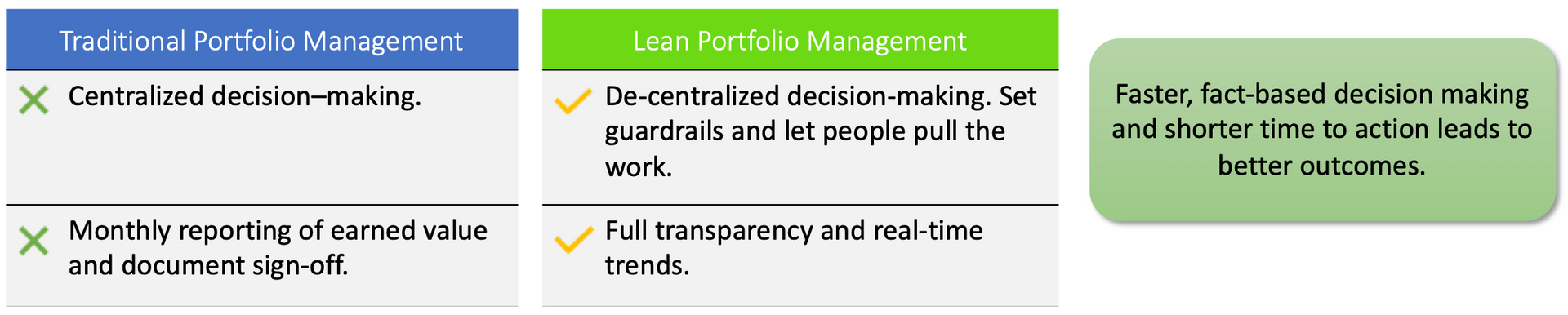

Let people focus and own their products.

And finally, this will impact on the way we treat our team members. Traditionally, we devise a project, we sign off on the plans, and then we go and recruit people into the project.

In traditional organizations, it's not unusual for people to be working on four or five different projects, and potentially different product lines, all at the same time. And when that work is over, they move on, and the organization forgets the lessons that they've learned as they move on to other projects and other product lines.

In an agile world, we're going to have long-lived teams that organize themselves around our products and product lines. These teams allow us to have more ownership, more accountability, and more pride in the products and services we deliver, which in turn allows our organization to flex and adjust, to optimize that delivery of value.

The increased ownership and accountability within the teams will get us higher throughput and fewer delays in our delivery of the innovative solutions that we require for our long-term success.

Wrap Up

So, all in all, there's a lot of potential in transitioning from a traditional to a leaner portfolio management approach.

It does mean that you’re going to have to work in a different way, focused on optimizing the flow of value to achieve the best return on investment. We need to empower our decision makers to make decisions and have them acted on quickly, whilst empowering our teams to get on with delivering the value that they can.

- We will work smarter; we will get better alignment and can spend a larger amount of our funding on our top priorities.

- We will maximize the flow of value to improve our return on investment.

- And as our priorities change, we can move the funding and move the effort to focus on those things.

- Resulting in our money being better spent.

- We can act on our decisions and get faster at delivery, increasing our throughput with more features released successfully, an acceleration of value with faster delivery and more frequent releases.

- Our products will be more compelling and more relevant; we will become increasingly competitive and better placed against our competition.

With the result that we have happier customers, increased business satisfaction and happier teams.

So, you can see: It's a big change, but worth it.

Slides and Webinar

I put all this information into

two slides that seemed to work really well and that I want to share with you.

We will send you the slides for your own use

at the end of our next LeanAgileLunch

webinar:

So it will be well worth registering for the webinar on

our website here;

or register on

LinkedIn here.