Ian Spence

Scagilize Network Partner (Trainer & Consultant), Advisor & SAFe Fellow

Ian Spence on:

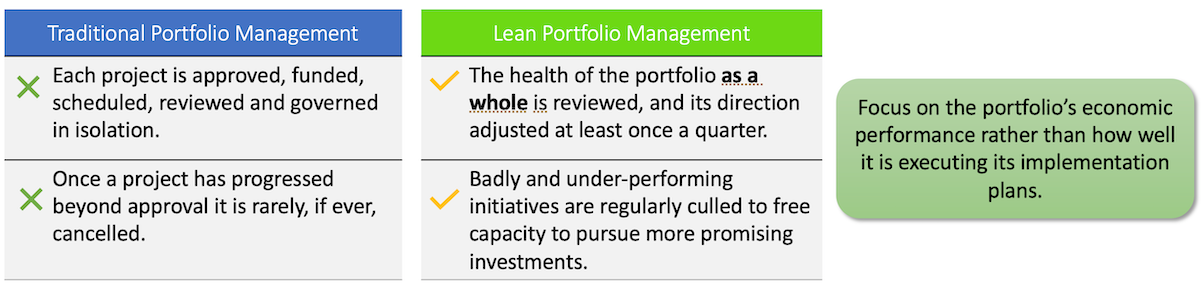

The Fundamental Difference Between Traditional and Lean Portfolio Management Approaches

Whilst working on the first draft of my forthcoming European SAFe Summit presentation “Engaging Leadership with Jargon Free LPM”, I realized that I had missed one of the most fundamental differences between traditional and Lean Portfolio Management (LPM) approaches in my previously published Jargon Free LPM blog series.

It’s quite simple really:

When practising Lean Portfolio Management, you focus on the economic performance of the Portfolio as a whole rather than the administration of the individual projects, programs, products, initiatives or epics that make up the portfolio.

Or presenting this observation in the style of the earlier articles:

- An approval body, not a review body. An approval body is set up to rubber stamp ‘perfect’ business cases. It focusses on the approval of new projects. It never considers whether the previously approved projects should be cancelled or the investment profile adjusted, and rarely, if ever, returns to examine the resulting return on investment. This topic is discussed in more detail in the “Hidden Benefits of LPM Part 2: Eliminating Dark Work” blog.

- Individual, independent steering committees. A unique steering committee is set up for each project. A committee that operates with little or no consideration of the other things going on within the portfolio. One that is emotionally connected to the success of the project even though it is the sole body that will determine whether or not it should progress.

- Pivot only as a last resort. Any form of pivot away from, or cancellation of, a project after approval is seen as a failure. It is only ever considered as a last resort when everyone agrees that the project will fail catastrophically.

- Passive portfolio administration rather than active portfolio management. Many portfolio managers have no part to play in how, when, or where investments are made. They just provide an administrative function to ensure that a set of projects, set up and approved by others, are run professionally. If you don’t have the authority to halt any of the in-flight projects within the portfolio or adjust its investment profile, then you are not really the portfolio manager.

It should be noted that these issues are not limited to organizations pursuing waterfall methods and are just as prevalent in organizations adopting agile project management approaches and, dare I say it, many organizations claiming to practice LPM.

LPM addresses these issues by regularly inspecting and adapting the investment profile of the portfolio as part of a Strategic Portfolio Review (SPR). This will happen at least once a quarter (or for those of your well-versed in SAFe at least once a PI). Personally, I prefer to do this at least twice a quarter (or twice a PI) – I’ll cover the reasoning behind this in a future blog.

The SPR should consider all in-flight (both pre- and post- approval) work within the portfolio and balance this against the available capacity, the current budgets, and the future investment plans.

At this event not only will the business cases for any new initiatives seeking approval be considered but the business cases for all post-approval initiatives will be revisited and reviewed against their revised estimates and delivered business value. It is always a good idea to ask the question “Given everything that’s going on, why should investment in this initiative continue, would the money be better invested elsewhere?”.

The attendees will also be involved in the more frequent Portfolio Synchs but these will be shorter and have less breadth than the regular strategic portfolio reviews.

It’s the switch in focus from the fire and forget, individual administration of each project in the portfolio to the regular, cadence-based examination of the full set of investments that is one of the fundamental differences between traditional and lean portfolio management approaches.

Attributions:

- SAFe and Scaled Agile Framework are registered trademarks of Scaled Agile, Inc.